Life Insurance in and around Taylor

Get insured for what matters to you

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

It may make you uneasy to contemplate when you pass, but preparing for that day with life insurance is one of the most significant ways you can express love to the people you're closest to.

Get insured for what matters to you

Don't delay your search for Life insurance

Agent Sandy Gilland, At Your Service

Having the right life insurance coverage can help loss be a bit less debilitating for those closest to you and provide space to grieve. It can also help cover certain expenses like car payments, home repair costs and your funeral costs.

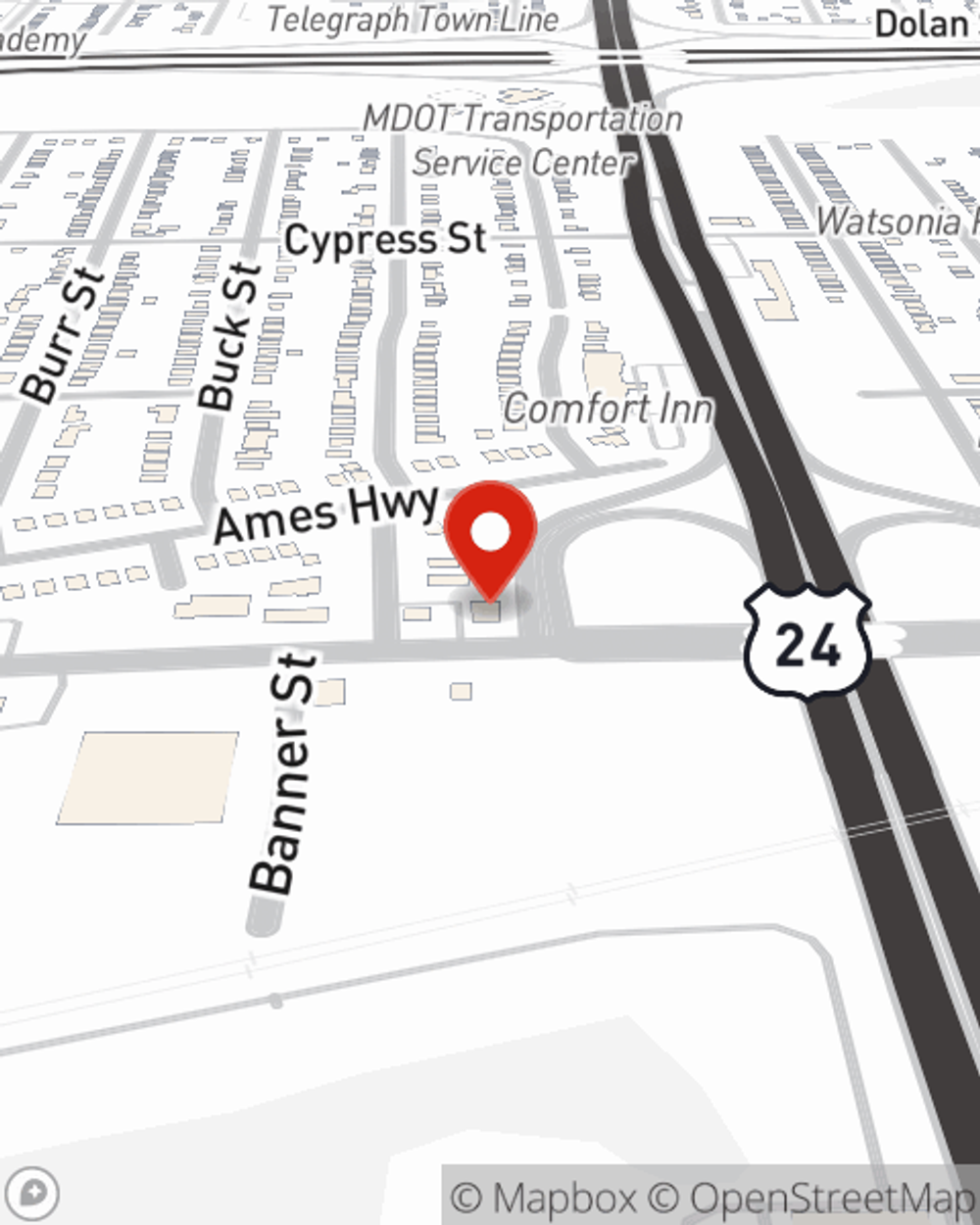

With responsible, considerate service, State Farm agent Sandy Gilland can help you make sure you and your loved ones have coverage if the worst comes to pass. Reach out to Sandy Gilland's office now to get started on the options that are right for you.

Have More Questions About Life Insurance?

Call Sandy at (313) 295-5656 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Sandy Gilland

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.